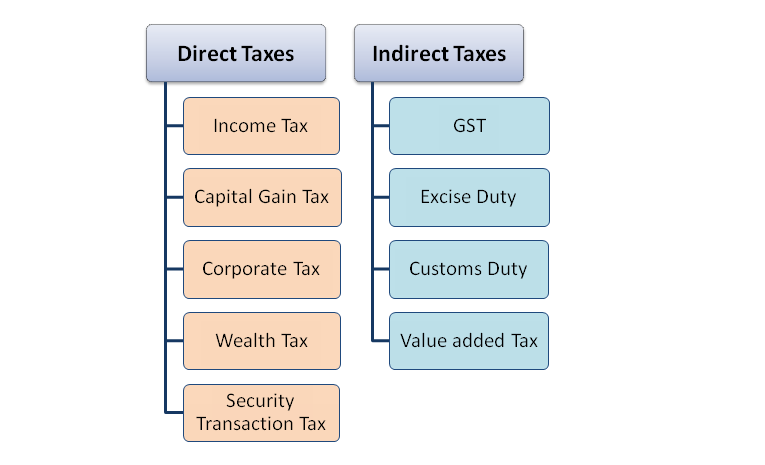

Direct Taxes and Indirect Taxes Management

“Next to being shot at and missed, nothing is really quite as satisfying as a tax refund.”

Effective tax management is one of the hidden hands that help entrepreneur to develop business. We, at GrowBizz assist business organizations to manage one its costliest affair that is tax affairs. We can assist in management of direct and indirect taxes applicable at every stage of your business in following ways:

Direct Tax related Services

PAN or TAN Registration

PAN stands for Permanent Account Number and TAN stands for Tax Deduction Account Number. TAN is to be obtained by the person responsible to deduct tax, i.e., the deductor. In all the documents relating to TDS and all the correspondence with the Income-tax Department relating to TDS one has to quote his TAN. PAN cannot be used for TAN, hence, the deductor has to obtain TAN, even if he holds PAN.

Importance of PAN:

- For payment of direct taxes

- To file income tax returns

- To avoid deduction of tax at higher rate than due

- To enter into specific transactions as notified by government

Income Tax Return Filing

- Easy Loan Approval: Filing the ITR will help individuals, when they have to apply fora vehicle loan (2-wheeler or 4-wheeler), House Loan etc. All major banks can ask for a copy of tax returns.Claim Tax Refund: If you have a refund due from the Income Tax Department, you will have to file an Income Tax Return to claim the refund.Income & Address Proof: Income Tax Return can be used as a proof of your Income and Address.Quick Visa Processing: Most embassies & consulates require you to furnish copies of your tax returns for the past couple of years at the time of the visa application.

- Carry Forward Your Losses: If you file return within due date, you will be able to carry forward losses to subsequent years, which can be used to set off against income of subsequent years.

- Avoid Penalty: If you are required to file your Tax returns but didn’t, then the tax officer deserves the right to impose a penalty of up to Rs.5,000.

Income Tax Audit

Tax Planning and Tax Saving

Corporate Tax Advisory

International Tax

Tax Litigations

Trust registration (80G and 12AA)

-

Indirect Tax related Services