Trust Registration

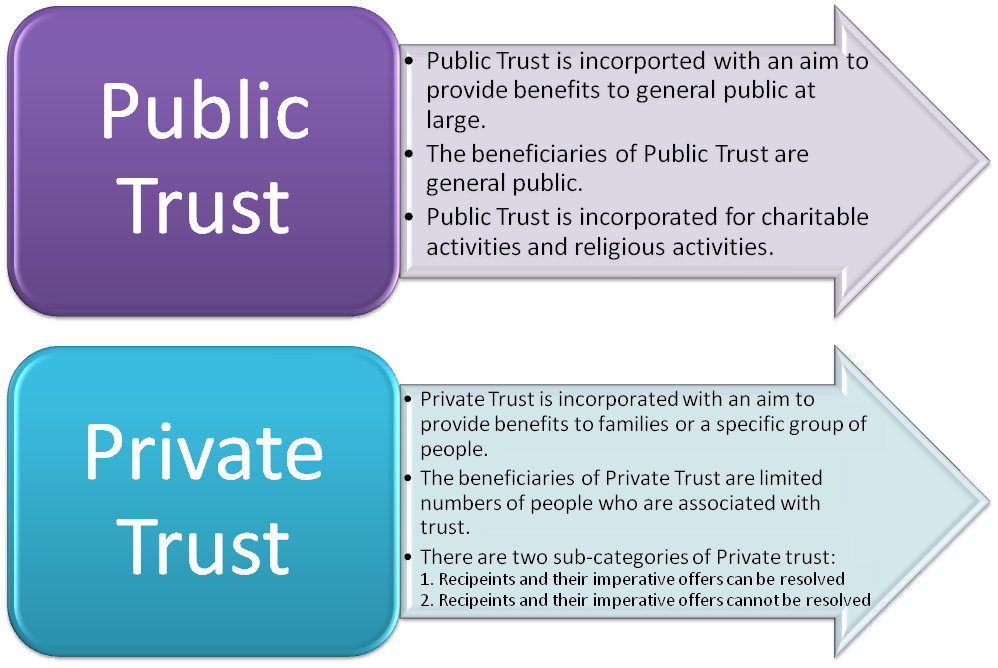

Registration of Trust can be done with a proper execution of a trust deed following its registration with the authority. There are two types of trusts are working in India, public trust and private trust. A Public Trust is created for a large group of people like NGO’s, charitable institutions, etc. while a Private Trust is created for closed group; in other words for their beneficiaries; like a trust created for a family, or group of family, etc. Start your registration with GrowBizz today and our professional team helps you with quick and easy registration.

Advantages of Trust Registration

- Activities of trust have been provided with the benefits of tax exemption of fulfillment of certain conditions.

- Trust incorporated for charitable purposes are known as non-profit organizations.

- Tax benefits available to the donors in specified cases.

- Business activities can be carried out under a trust.

Documents required for Registration

- Copy of PAN card of all the members of trust

- Identity and address proof of all the members of trust (Passport / Aadhar Card / Voter ID / Driving License)

- Address proof of the registered office (Ownership Document or Rent Agreement, and Copy of Utility Bill)

- NOC (No Objection Certificate) from owner in case of Rented Property

- Passport Size Photographs of all the members of trust

- Proposed name of the trust

Disclaimer:

- Additional details or information or documents other than mentioned in above list; may be called if required.

- A trust required be a registered one and must engaged in legal activities in order to avail the various benefits offerred by the government.

- A trust deed is required to be developed for registration of a trust.

- Value of stamp duty payable on registration of trust is dependent upon property value of trust.